When it comes to selling life insurance, phone calls are the most effective and impactful way of initiating conversations with potential customers. You get that opportunity to build a sense of trust, credibility, and personal connection with the prospect that wouldn’t be possible to achieve through a cold email. Plus, you can immediately address the prospect’s concerns, answer questions, and move them faster through the sales funnel.

But there’s more than just picking up the phone and dialing a number. You need to be prepared, know what to say, how to open a conversation, how to present your sales pitch, and how to handle objections effectively. Life insurance sales scripts serve exactly that purpose, helping you sound professional and confident.

In this blog, we’ll walk you through the best practices for selling life insurance over the phone and provide some ready-made life insurance sales script examples you can get inspiration from to help you improve your sales conversions.

How to Sell Life Insurance Over the Phone: Best Practices

Arm yourself with relevant knowledge

Whether you sell life insurance, auto insurance, mortgage protection insurance, or business insurance – preparation is key. Firstly, you obviously need to know the ins and outs of the life insurance plans you are selling. And secondly, you need to have a solid understanding and background knowledge of your target audience.

- Who are your potential customers (demographics, health status, financial situation)?

- What are the common characteristics among your target demographic?

- What are their major pain points and challenges that your offering solves?

- What factors are most important to them when choosing a life insurance company?

- What makes your offering unique, and why should they choose you over competitors?

The better you know your products and the more you know about your prospects – the more confident you sound and the better you can tailor your sales pitch. That creates the foundation for more efficient and productive conversations.

Equip yourself with the right call center technology

Call center software with auto dialing capabilities

Selling life insurance over the phone is all about proactively reaching out to your prospects through cold calls. And this is where the right call center software for insurance industry can make a difference. While dialing numbers from your calling list manually and waiting for the calls to connect might be tedious and extremely time-consuming, you can optimize this process with an auto dialing solution.

For example, VoiceSpin’s AI dialer software for call centers automatically dials through the list of numbers and skips busy signals, disconnected numbers, and answering machines, connecting agents only to the calls answered by prospects. That can save your insurance agents a great deal of time and effort, helping you improve the efficiency of your outbound calling campaigns and close more deals.

Local caller ID

Getting your prospects to pick up the phone is one of the biggest challenges sales agents face when running outbound cold calling campaigns. The insurance industry is no exception. The majority of people are unlikely to answer calls from unknown numbers because they simply consider them spam calls – but local presence dialing can help you build trust with prospects and increase call pick-up rates. With local presence dialing, your prospects will see the number with the local area code as a caller ID. And based on a study by Software Advice, people are nearly four times more likely to answer calls from local numbers.

Voicemail drop

Stats say that around 80% of cold calls go to voicemail, while a typical sales agent leaves nearly 70 voicemails per day on average. With voicemail drop, your reps won’t have to waste a considerable amount of their productive time doing that the traditional way. Voicemail drop – a common feature of auto dialing solutions – allows you to automatically leave a pre-recorded message in your prospects’ voicemail inbox, which is a great, non-intrusive way for your insurance agents to reach potential customers who don’t always answer calls.

Know the best times to call your prospects

While there may be multiple reasons for low call answer rates – sometimes the timing just isn’t right. So what’s the best time to cold call your prospects? Well, there’s no single right answer to that question. However, numerous studies have found that calling prospects during specific times throughout the day (and on specific days of the week) can increase your chances of reaching out to your prospects. Here’s what various studies revealed:

- Based on Yesware’s analysis of over 25,000 sales calls, late afternoons are a good time to make cold calls, while the majority of calls that last over five minutes typically occur between 3:00-5:00 pm on Tuesdays or Thursdays.

- According to a study by CallHippo, the best time to cold call is between 4:00-5:00 pm, followed by the second best time to cold call between 11:00 am – 12:00 pm. Wednesday tends to be the best day to cold call your prospects.

- A study by Revenue.io found that decision-makers are more likely to engage in the late afternoon, with the most optimal time to cold call during 4:00-5:00 pm. This peak engagement window is closely followed by the 3:00-4:00 pm and 5:00-6:00 pm hours.

- After analyzing datasets of 11 million calls over four years, PhoneBurner’s survey revealed that the best times to cold call are between 10:00 am – 2:00 pm, while Tuesday is the best day of the week to cold call, followed closely by Monday and Wednesday.

Create well-thought-out life insurance scripts

With well-crafted insurance scripts, agents can confidently navigate through conversations, effectively communicate their message, and ensure that no important information gets overlooked. Scripts also guide agents on how to address common concerns and objections prospects might have. What’s also important, with ready-made scripts, you can easily maintain consistency across all your conversations. Here are the key points your life insurance sales script should include:

- Opening statement (This is where you greet the prospect and briefly introduce yourself and your insurance company).

- Purpose of your call (This is where you explain the purpose of the call to the prospect, preferably in one short sentence).

- Needs assessment (This is where you ask open-ended questions and show genuine interest in getting to know more about your prospect’s needs, pain points, challenges, etc.).

- Product introduction (This is where you finally introduce your personalized sales pitch based on what you’ve learned about your prospect and their needs).

- Closing and CTA (This is where you set clear expectations regarding the next steps to keep the conversation going).

Personalize your sales pitch

Whatever you are selling – a SaaS product or life insurance – personalization goes a long way in helping you build trust and rapport with prospects and improve conversion rates. Though you may not have detailed data about your prospects when you are cold calling them for the very first time, asking open-ended questions throughout the conversation can help you reveal that critical information and adjust your sales pitch accordingly.

On top of that, personalization helps increase retention when you are dealing with existing customers. According to Accenture, insurers that offer personalized experiences and products that are tailor-made for their customers see an 81% increase in customer retention and an 89% increase in customer engagement.

Be ready to handle objections like a pro

Objections are inevitable, and you need to be ready to anticipate and handle them professionally. Whether it’s cost concerns, perceived lack of need, misconceptions about coverage, or overall skepticism about insurance companies – agents are bound to face multiple objections along the way. Including effective responses in your script templates will make life much easier for your reps. Let’s take a look at some common objections agents may encounter in the sales process:

- ‘I already have enough coverage through my employer.’

- ‘I’m young and healthy, so I don’t need life insurance.’

- ‘I have investments and savings to cover my family’s needs.’

- ‘It’s too expensive. I have other financial priorities right now.‘

- ‘I don’t understand how life insurance works.’

- ‘I need to discuss it with my family first.’

- ‘I don’t trust insurance companies.’

- ‘Will you really pay out if something happens to me?’

- ‘I don’t want to be locked into a long-term commitment.’

- ‘I already have life insurance from another provider.’

Follow up with prospects consistently

According to the stats published by Yesware, only 2% of sales happen during the first point of contact, while 60% of customers reject four times before finally making a purchase decision. At the same time, 80% of sales deals take five or more follow-ups to close, yet 44% of sales reps stop after the first unsuccessful attempt. It ultimately means that giving up after the first ‘no’ from a prospect might be a missed opportunity. When you make a follow-up call, you get a chance to address any remaining questions or concerns and move the prospect closer to that final decision stage.

Learn from past interactions and improve

No matter how well you think you’ve prepared, some calls will not go as planned. The good news is that it isn’t always bad because it gives you an opportunity to analyze past interactions and understand what went wrong, where your sales scripts need adjustments, and where you might lack specific skills. Luckily, the absolute majority of call center software solutions allow you to record calls automatically and playback the recordings later so you can evaluate the quality of past interactions and see what could be improved.

Life Insurance Sales Script Examples That Work

So what does it all look like in practice? Below, we’ve provided some life insurance sales pitch examples covering various scenarios. Use them as a guidance when crafting your own life insurance sales scripts:

Life insurance sales script example #1: Selling to a warm lead

Agent: Hi [Prospect Name]. This is [Agent Name] with [Company Name]. I’m getting back to you about the life insurance policy information you recently requested on our website. I wanted to provide you with some details and answer any questions you might have. Do you have a few seconds to learn more about our options?

Prospect: Sure, go ahead.

Agent: Great! Based on the information you provided, here’s what we can offer [provide brief information about each offering].

Life insurance sales script example #2: Offering a free quote

Agent: Hello [Prospect Name], my name is [Agent Name] with [Company Name]. How are you doing today?

Prospect: I’m doing well, thanks.

Agent: I’m reaching out today to discuss how we can help protect your family’s financial security with our life insurance solutions. I’d love to offer you a free quote for our life insurance policies. This will just give you a better idea of what insurance coverage options are available and how much they would cost you, with absolutely no obligation to buy. How does it sound?

Life insurance sales script example #3: Selling to a current customer

Agent: Hi [Customer Name], I’m [Agent Name] from [Company Name]. I see you’ve been with us since [year]. How has that been?

Customer: Hi [Agent Name], it’s been good so far.

Agent: Fantastic! Today, I’d love to talk to you about how we can continue to meet your current needs with our life insurance options. Can I show you the key benefits of our most popular life insurance plan?

Life insurance sales script example #4: Explaining life insurance benefits

Agent: Hi [Prospect Name], this is [Agent Name] from [Company Name] calling. How’s your day going?

Prospect: It’s been great, thanks for asking.

Agent: Excellent! I’m here to help you better understand the benefits of life insurance. Do you have a couple of minutes for that?

Prospect: Yes, go ahead.

Agent: Life insurance gives financial security to your loved ones if something unexpected happens to you. And life can sometimes be so unpredictable. If you were to pass away, would you want your spouse and children to have financial support to cover expenses like education costs and mortgage payments?

Life insurance sales script example #5: Overcoming common objections

Scenario 1: A prospect has budget concerns

Prospect: That is just too expensive for me.

Agent: I get it, it seems expensive. But let’s think about the long-term value of the life insurance plan, like financial security for your family and tax benefits. With the right policy, you can ensure their financial security, no matter what happens. And believe me, I’m not here to sell you something you can’t afford, but to help you find coverage that fits your budget.

Scenario 2: A prospect believes that it isn’t the right timing

Prospect: I don’t need life insurance now, I’m young and healthy.

Agent: It’s great that you’re young and in good health now, but life is unpredictable. Life insurance ensures your loved ones are financially protected if something unexpected happens. And it’s not about preparing for the worst. It’s more about smart financial planning and your peace of mind for the future.

Scenario 3: A prospect is skeptical about insurance companies

Prospect: I don’t really trust insurance companies.

Agent: I’ve worked with many clients who felt the same way initially, and I perfectly understand why. But let me tell you, insurance companies are heavily regulated by state and federal governments to make sure they actually keep their promises to policyholders. And that means you’re always getting the coverage you’ve paid for. Let me just briefly walk you through the policy details, so you can see exactly what you’re getting and how it works.

Scenario 4: A prospect has an existing insurance policy from a competitor

Prospect: I already have life insurance.

Agent: Good for you, so you’ve already taken care of your family’s financial future! I’d still like to offer you a free review of your current policy so we can ensure you’re getting the best possible coverage for your specific needs. And you can compare the two options side by side to see which one is better for you.

Scenario 5: A prospect isn’t ready to make a final decision

Prospect: I’ll have to talk to my partner first.

Agent: Sure, I totally understand, you should make these decisions together. I’ll email you the details we discussed today. And we can also schedule a follow-up call or meeting with your partner so I could answer any questions you both might have and help you make a decision together. How does that sound?

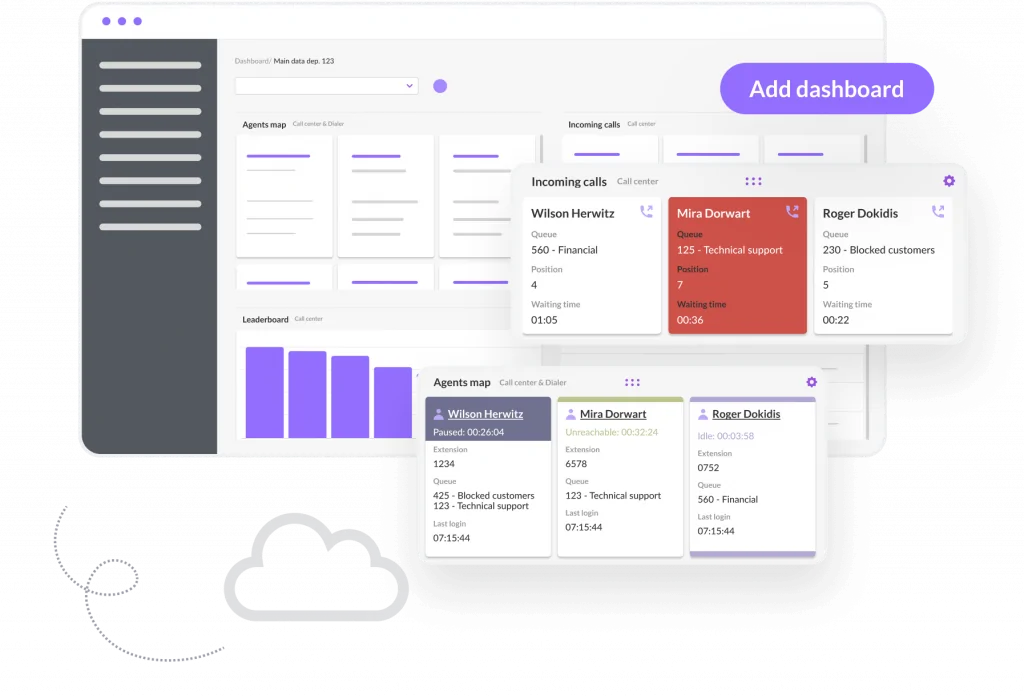

Empower Your Team with VoiceSpin’s Insurance Call Center Software

Selling life insurance over the phone doesn’t have to be complicated when you’re well-prepared and know exactly what to say and how to navigate conversations with confidence in every possible scenario. And what’s more, you can also maximize the efficiency of your calling efforts with the right call center technology. VoiceSpin’s call center software has all the tools, features and capabilities for insurance companies like yours to make your reps even more efficient and productive.

- AI predictive dialer: With a predictive dialer, your reps can make more outbound calls in less time – while the dialer’s AI and ML algorithms ensure that leads are connected to the best-suited agents to help you boost conversions.

- Local caller ID: Increase your call answer rates (which is a common problem when running outbound calling campaigns) by using numbers with a local area code when calling your prospects or customers.

- Voicemail drop: Leverage automated voicemail drop and get your pre-recorded messages delivered to your prospects even when they don’t pick up while also reducing the need for your reps to do it manually whenever the dialer reaches voicemail.

- Call recording: Record calls and review call recordings later on for QA or agent training purposes. Playback recorded calls to train newly hired agents by demonstrating examples of how your top-performing reps handle objections.

- Real-time call monitoring: Hear first-hand how your agents interact with customers and prospects with real-time call monitoring. Assess your team’s performance and identify knowledge or skill gaps and where additional training is needed.

- Custom reporting: Review ready-made or build custom reports to track calls per agent, average call duration, conversion rates, and other metrics and KPIs to better measure your team’s efficiency and make more data-driven decisions.

- AI call summary: Review AI-generated summaries of every call to get quick insights into previous interactions to have better context for future follow-ups. Evaluate agent performance and identify opportunities for improvement.

- CRM integration: Give your agents instant access to customer data and the history of previous interactions to deliver more personalized experiences when calling existing customers and warm prospects with CRM integrations.

Book a demo call now and talk to one of our sales reps to see VoiceSpin’s insurance call center software in action and make a more informed decision.

FAQs:

Is selling life insurance over the phone effective?

Absolutely yes! While traditional face-to-face meetings have long been the lifeblood of the insurance industry, they are no longer the only way to get things done in the insurance sector. With the right call center tools, strategy, impactful scripts, and objection-handling techniques, selling life insurance over the phone can be incredibly effective. Moreover, while most customers are ready to get quotes online, research proves phone calls remain the preferred channel for conversion, ranking higher than online and in-person.

What is the best time to call potential life insurance customers?

There is actually no single right answer to this question. But based on numerous studies, the best times for cold calling are typically considered late mornings (between 10 AM – 12 PM) and early evenings (between 5 PM – 5 PM) during weekdays. A general rule of thumb here is to avoid early mornings, lunch hours (12 – 1 PM), late evenings (after 6 PM), and weekends – that’s when prospects will likely be unavailable or less receptive to take calls.

Can I sell life insurance without being pushy?

Yes, you can (and you should). In fact, a consultative, educational approach is often a lot more effective than high-pressure sales tactics. Simply focus on understanding each prospect’s needs, priorities, motivations, and concerns before discussing products. Ask thoughtful, open-ended questions, employ your best listening skills, and recommend coverage options based on their specific situation. When prospects feel heard and understood – and when you position yourself as an advisor rather than a salesperson – they are more likely to trust you and buy from you without feeling pressured.

What are the most important skills for selling insurance over the phone?

The most important skills for successfully selling life insurance over the phone include:

- Active listening (identifying each prospect’s underlying needs and concerns)

- Clear communication (explaining complex insurance concepts in simple terms)

- Empathy (validating emotions and creating authentic emotional connections)

- Objection handling (addressing the most common objections with confidence)

- Phone-specific skills (mastering voice modulation/ pacing and managing silence)

Develop and practice these skills along with excellent product knowledge – and you’re all set up for success.

How to convince a customer to buy an insurance policy?

Start by shifting your mindset first: you’re not ‘convincing’ them to buy an insurance policy – you’re helping them make an informed decision and solve real problems (e.g., overcoming a fear of leaving their loved ones in debt). And your job is to simply connect the dots between their needs and the solution and help them see the value for themselves. Plus, it greatly helps to use storytelling and real-life examples relevant to their circumstances. Relatable stories create emotional engagement and build trust and credibility.

+18889082995

+18889082995

+442036084160

+442036084160

+97237237006

+97237237006